The Definitive Guide to Pacific Prime

The Definitive Guide to Pacific Prime

Blog Article

The Buzz on Pacific Prime

Table of ContentsPacific Prime Can Be Fun For AnyonePacific Prime Can Be Fun For AnyoneThe 3-Minute Rule for Pacific PrimeThe Ultimate Guide To Pacific PrimeNot known Factual Statements About Pacific Prime

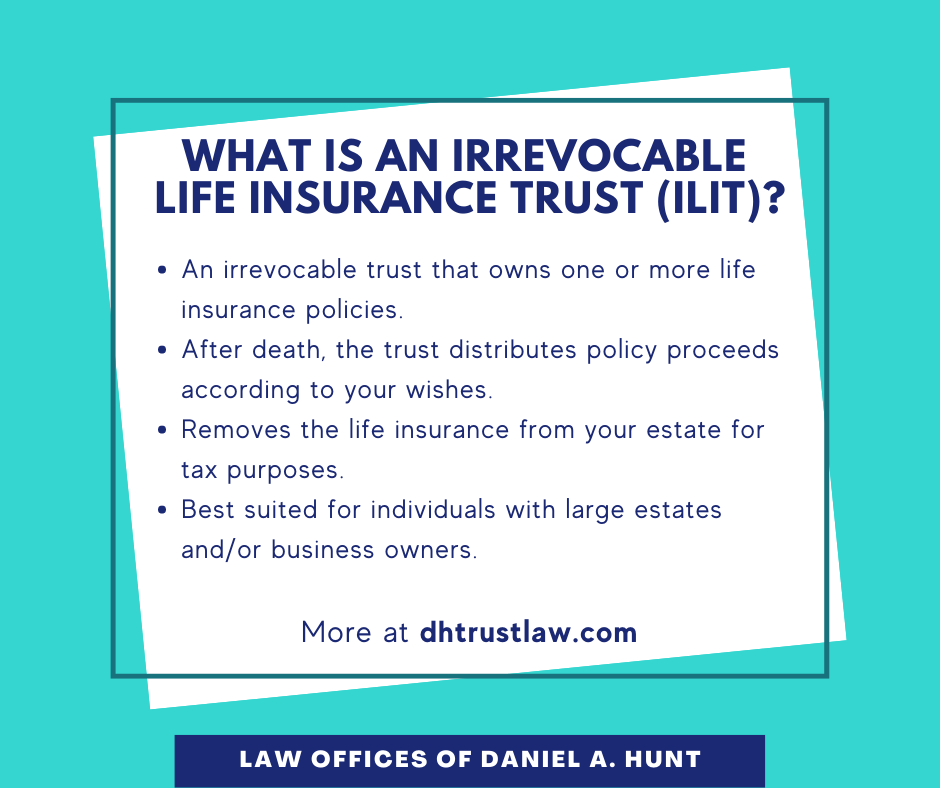

Insurance coverage is a contract, represented by a policy, in which a policyholder receives economic protection or reimbursement against losses from an insurer. The firm pools clients' dangers to pay a lot more budget friendly for the insured. Many people have some insurance coverage: for their auto, their home, their health care, or their life.Insurance coverage likewise helps cover costs connected with responsibility (lawful obligation) for damages or injury caused to a 3rd party. Insurance is an agreement (policy) in which an insurance company indemnifies one more against losses from certain backups or risks. There are lots of types of insurance coverage. Life, health, property owners, and auto are amongst the most usual forms of insurance coverage.

Investopedia/ Daniel Fishel Numerous insurance coverage policy types are available, and essentially any kind of specific or company can find an insurance coverage company willing to guarantee themfor a cost. Most individuals in the United States have at least one of these types of insurance policy, and auto insurance policy is called for by state legislation.

Pacific Prime Things To Know Before You Buy

So discovering the price that is appropriate for you requires some research. The plan limit is the maximum amount an insurance company will pay for a protected loss under a plan. Maximums might be set per period (e.g., annual or policy term), per loss or injury, or over the life of the policy, additionally understood as the lifetime optimum.

Plans with high deductibles are commonly much less expensive because the high out-of-pocket expense usually leads to fewer small claims. There are various kinds of insurance. Allow's check out the most vital. Medical insurance aids covers routine and emergency treatment expenses, usually with the choice to include vision and oral services individually.

Several precautionary services may be covered for complimentary before these are met. Health insurance might be bought from an insurance policy company, an insurance policy representative, the federal Wellness Insurance coverage Marketplace, supplied by an employer, or government Medicare and Medicaid coverage.

Pacific Prime Things To Know Before You Buy

Rather than paying of pocket for automobile mishaps and damages, people pay annual costs to a vehicle insurer. The firm then pays all or a lot of the protected expenses linked with an auto mishap or other vehicle damage. If you have actually a rented automobile or borrowed money to get a vehicle, your loan provider or leasing dealer will likely need you to carry car insurance coverage.

A life insurance policy plan guarantees that the insurance company pays a sum of money to your beneficiaries (such as a partner or children) if you pass away. In exchange, you pay you could look here costs during your lifetime. There are 2 primary kinds of life insurance policy. Term life insurance policy covers you for a certain period, such as 10 to twenty years.

Long-term life insurance policy covers your entire life as long as you continue paying the premiums. Travel insurance policy covers the prices and losses connected with traveling, including trip cancellations or hold-ups, protection for emergency health and wellness care, injuries and evacuations, harmed luggage, rental vehicles, and rental homes. Also some of the ideal traveling insurance policy firms do not cover terminations or delays because of weather, terrorism, or a pandemic. Insurance policy is a way to manage your economic threats. When you get insurance coverage, you buy protection versus unanticipated monetary losses. The insurance policy firm pays you or someone you choose if something bad takes place. If you have no insurance and a mishap occurs, you might be accountable for all related expenses.

Things about Pacific Prime

Although there are numerous insurance plan types, a few of the most usual are life, wellness, homeowners, and car. The right type of insurance policy for you will certainly rely on your objectives and economic circumstance.

Have you ever before had a moment while checking out your insurance plan or looking for insurance policy when you've assumed, "What is insurance policy? And do I truly need it?" You're not alone. Insurance policy can be a mystical and perplexing point. Just how does insurance policy work? What are the benefits of insurance? And just how do you find the most effective insurance policy for you? These prevail inquiries, and fortunately, there are some easy-to-understand responses for them.

No one wants something bad to occur to them. Enduring a loss without insurance coverage can place you in a challenging economic situation. Insurance is a crucial financial device. It can assist you live life with less fears knowing you'll receive monetary help after a catastrophe or crash, helping you recoup quicker.

7 Easy Facts About Pacific Prime Explained

And sometimes, like automobile insurance coverage and employees' compensation, you may be needed by law to have insurance coverage in order to shield others - international health insurance. Discover ourInsurance alternatives Insurance coverage is essentially an enormous nest egg shared by many individuals (called policyholders) and handled by an insurance policy service provider. The insurance provider utilizes cash gathered (called premium) from its insurance holders and various other investments to spend for its operations and to satisfy its guarantee to policyholders when they file a case

Report this page